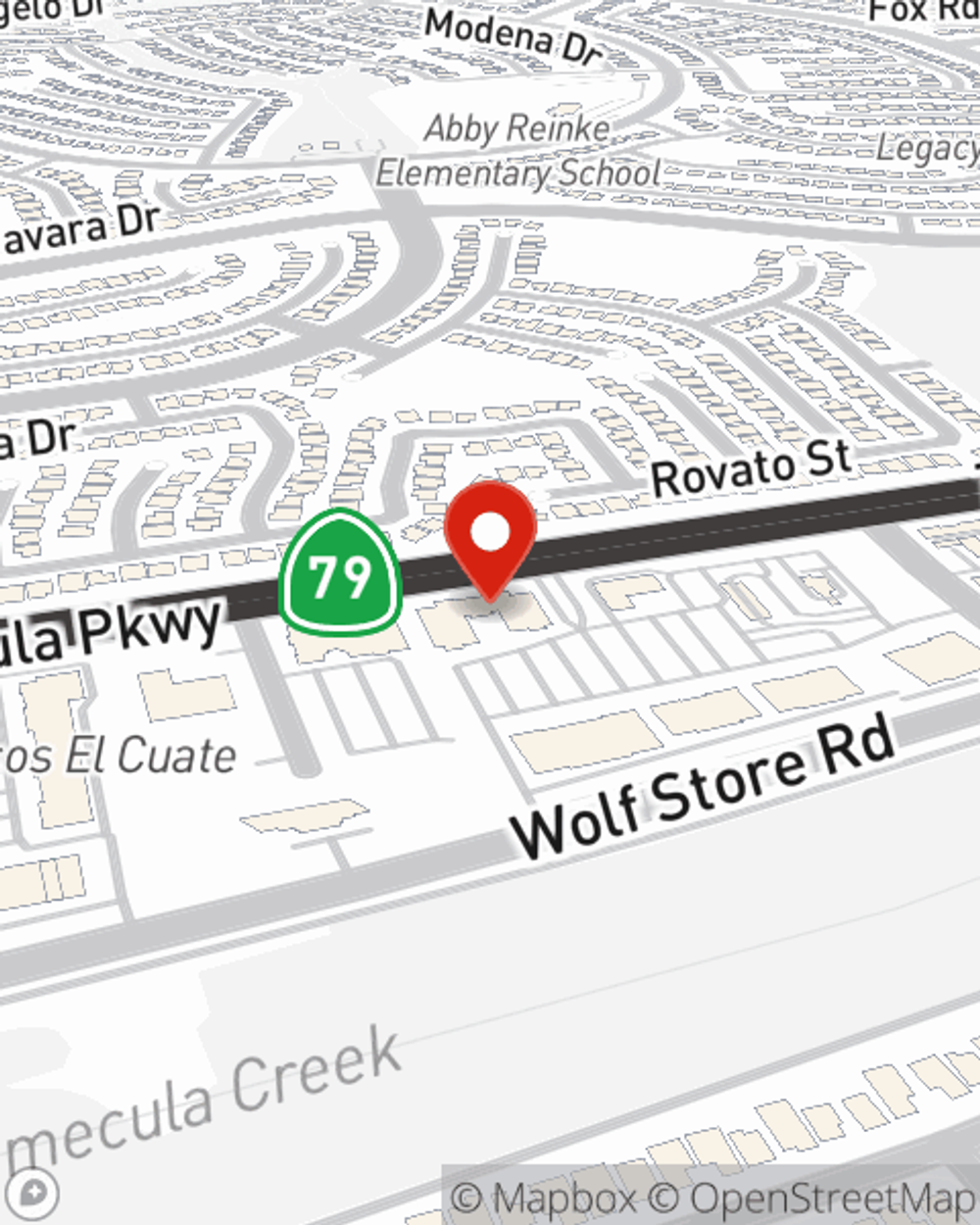

Homeowners Insurance in and around Temecula

Protect what's important from the unexpected.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Temecula

- Wildomar

- Menifee

- Murrieta

- Sun City

- Riverside

- French Valley

- Lake Elsinore

- Fallbrook

- Winchester

- Canyon Lake

- Hemet

Welcome Home, With State Farm Insurance

It's so good to be home, especially when your home is insured by State Farm. You never have to be concerned about the accidental with this excellent insurance.

Protect what's important from the unexpected.

Help protect your home with the right insurance for you.

Agent Elizabeth King, At Your Service

State Farm Agent Elizabeth King is ready to help you handle the unexpected with dependable coverage for your home insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Elizabeth King can help you submit your claim. Find your home sweet home with State Farm!

Ready for some help understanding the policy that's right for you? Get in touch with agent Elizabeth King's team for assistance today!

Have More Questions About Homeowners Insurance?

Call Elizabeth at (951) 302-9647 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Strategies to save for a house

Strategies to save for a house

Saving for a house means figuring out how to save money for a down payment. Use these helpful steps to get started.

Elizabeth King

State Farm® Insurance AgentSimple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Strategies to save for a house

Strategies to save for a house

Saving for a house means figuring out how to save money for a down payment. Use these helpful steps to get started.